The First Home Scheme

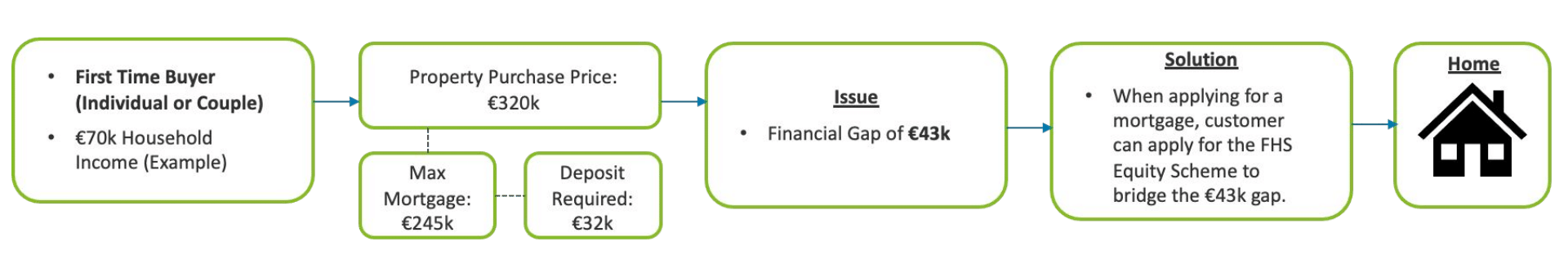

This is a shared equity scheme, bridging the gap for first time buyers and other eligible homebuyers between their deposit and mortgage, and the price of their new home.

Here are the main factors you need to keep in mind regarding the First Home Scheme in Ireland:

To be eligible for the Scheme you must:

To be eligible for the Scheme the property must:

How much funding can the FHS provide?

First Home Scheme at a glance:

How the Equity Share Works

The equity share provided by the First Home Scheme on day 1 will be a percentage of the property value (max available 30%, if availing of Help to Buy 20%):

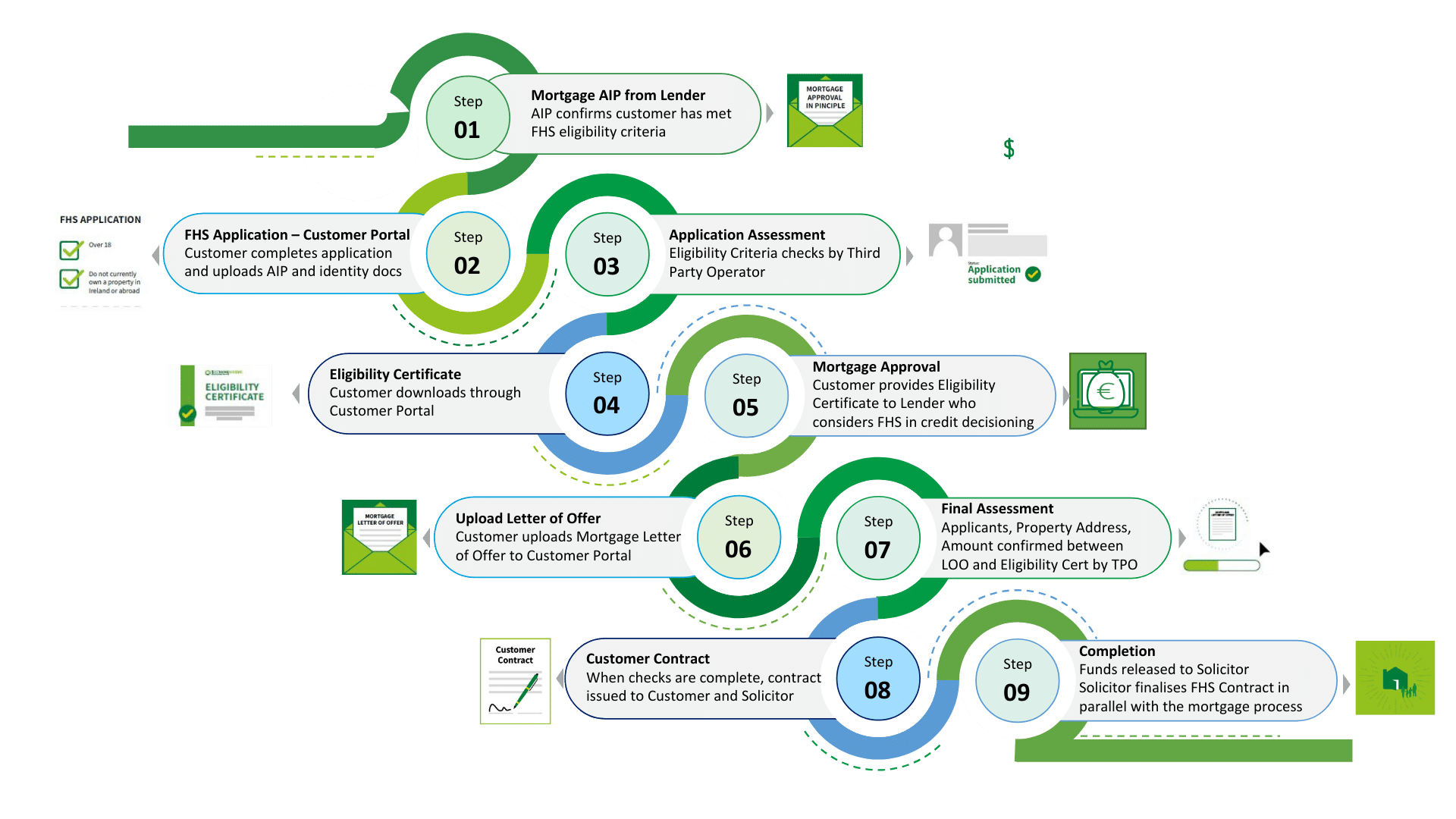

FHS Customer Journey